Developing good saving habits during adolescence is one of the most important steps toward long-term financial stability. Saving is not simply about putting money aside-it is about making your funds work for you and preparing for both short-term needs and future goals.

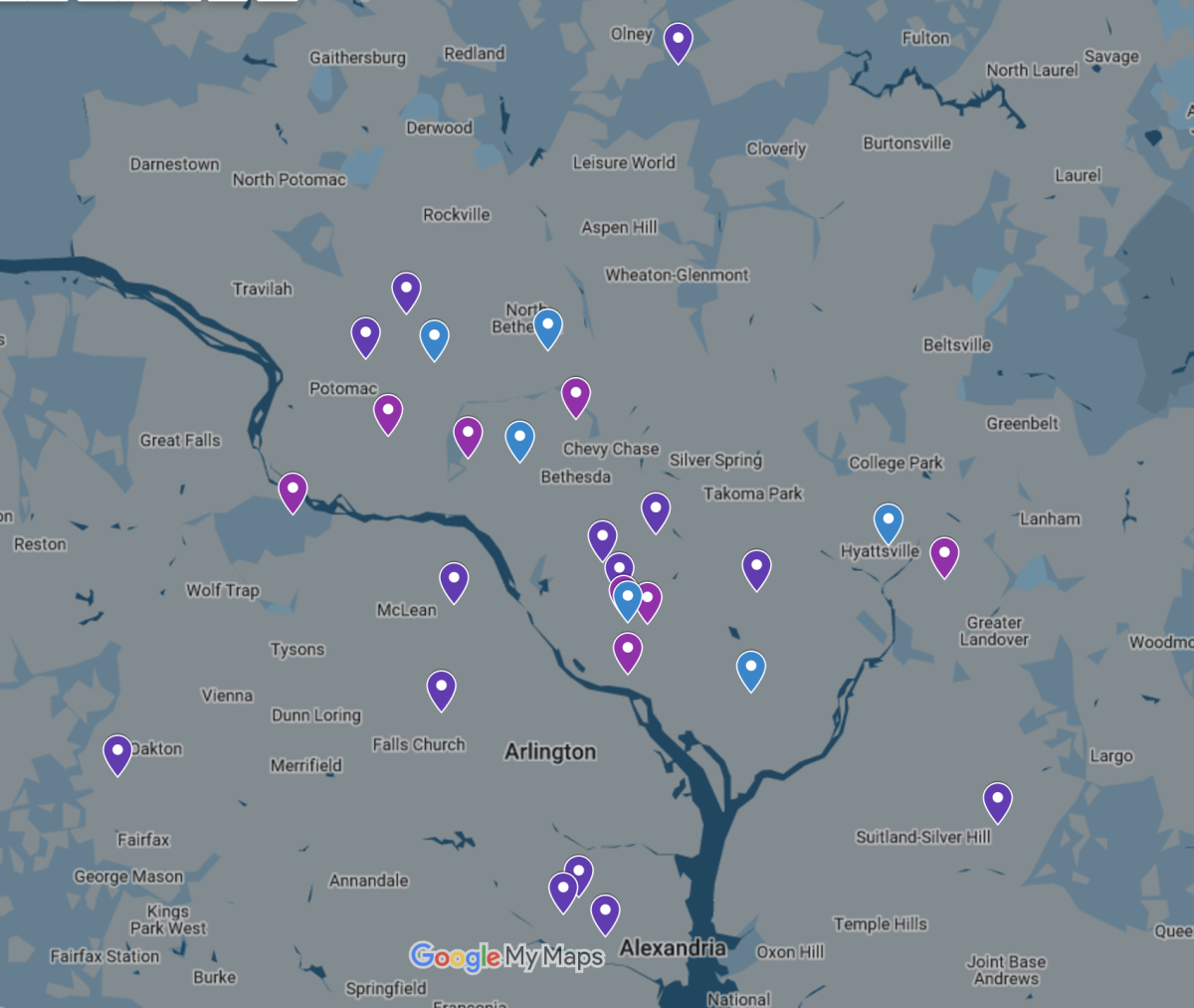

The national average interest rate for a standard savings account is currently around 0.39% APY. APY, or Annual Percentage Yield, represents the total rate of return on a savings account over one year, including the effect of compound interest. In practical terms, $100 left in a typical account for a year would earn less than fifty cents. Fortunately, many banks and credit unions offer accounts specifically designed for young savers, with significantly higher returns. Spectra Credit Union’s Brilliant Kids Savings Account provides 10.38% APY on the first $1,000, while FourLeaf Federal Credit Union’s Student Savings Account offers 5.00% APY on the same amount. Capital One’s Kids Savings Account yields 2.50% APY and requires no minimum deposit or monthly fees. Additionally, numerous online banks offer high-yield savings accounts with rates between 4-5% APY, though some may require a minimum balance or direct deposit.

Saving early allows teens to take advantage of compound interest, where money earns interest not only on the initial deposit but also on the accumulated interest over time. By regularly setting aside a portion of allowance, gift money, or earnings, typically 10 to 20 percent, teenagers can grow their savings significantly. In addition to building wealth, having a savings account provides flexibility for emergencies, personal goals, or future educational expenses.

In short, starting to save during adolescence is a critical step in developing financial responsibility. By choosing a secure, interest-bearing account and making saving a consistent habit, teens can set themselves up for financial independence and long-term success (especially for college).